Not known Facts About Medicaid

Wiki Article

Indicators on Health Insurance You Need To Know

Table of ContentsIndicators on Cheap Car Insurance You Should KnowThe 20-Second Trick For Car Insurance QuotesThe Ultimate Guide To Car Insurance QuotesThe Medicaid Diaries

You Might Want Impairment Insurance Policy Too "In contrast to what numerous individuals think, their home or automobile is not their best property. Rather, it is their ability to gain an income. Yet, lots of specialists do not insure the possibility of a special needs," said John Barnes, CFP and proprietor of My Family members Life Insurance Policy, in an email to The Equilibrium.

The information below focuses on life insurance policy offered to people. Term Term Insurance policy is the simplest form of life insurance policy. It pays just if death occurs during the regard to the plan, which is normally from one to thirty years. Most term policies have no various other benefit provisions. There are 2 fundamental sorts of term life insurance policy plans: degree term as well as lowering term.

The price per $1,000 of advantage increases as the guaranteed individual ages, as well as it certainly gets very high when the guaranteed lives to 80 and past. The insurance policy firm might charge a premium that increases yearly, however that would certainly make it extremely hard for many people to manage life insurance policy at innovative ages.

How Car Insurance Quotes can Save You Time, Stress, and Money.

Insurance plan are created on the principle that although we can not quit unfavorable events occurring, we can shield ourselves economically against them. There are a huge number of various insurance policies available on the marketplace, as well as all insurance providers attempt to persuade us of the benefits of their specific item. So much so that it can be tough to choose which insurance coverage are truly needed, and which ones we can genuinely live without.Scientists have actually located that if the primary breadwinner were to die their family would only have the ability to cover their home costs for simply a couple of months; one in four households would have issues covering their outgoings right away. The majority of insurance providers suggest that you get cover for around ten times your annual earnings - medicaid.

You need to additionally consider child care expenses, and also future college costs if applicable. There are 2 major types of life insurance policy to select from: entire life plans, and also term life plans. You spend for entire life plans up until you pass away, and also you spend for term life plans for a set period of time figured out when you obtain the plan.

Health Insurance coverage, Health And Wellness insurance coverage is one more one of the four main sorts of insurance coverage that experts suggest. A recent study revealed that sixty two percent of personal bankruptcies in the United States in 2007 were as a straight outcome of health issue. A shocking seventy 8 percent of these filers had health and my latest blog post wellness insurance coverage when their health problem began.

Some Known Details About Home Insurance

Premiums differ significantly according to your age, your present state of health and wellness, and your way of living. Vehicle Insurance coverage, Rule range various nations, but the importance of car insurance stays consistent. Also if it is not a legal demand to obtain auto insurance coverage where you live it is very advised that you have some type of policy in position as you will still need to assume monetary responsibility when it comes to a mishap.On top of that, your lorry is typically among your most valuable properties, and also if it is harmed in a mishap you may have a hard time to spend for fixings, or for a substitute. You can also locate on your own accountable for injuries received by your guests, or the chauffeur of one more automobile, and also for damages created to another lorry as a result of your carelessness.

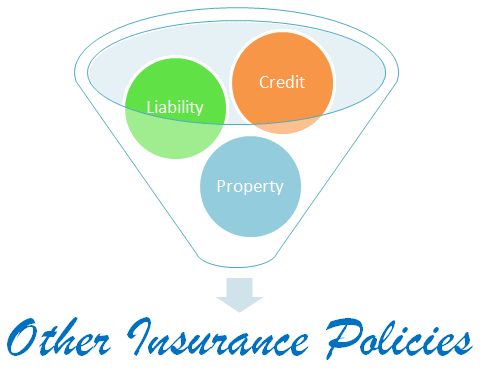

General insurance coverage covers residence, your traveling, car, and also health (non-life properties) from fire, floodings, mishaps, man-made disasters, and also theft. Various kinds of general insurance include electric motor insurance, medical insurance, travel insurance coverage, and residence insurance. A basic insurance plan spends for the losses that are incurred by the guaranteed during the duration of the plan.

Keep reading to recognize more about them: As the residence is a beneficial property, it is very important to safeguard your house with a correct. Residence as well as family insurance protect your house as well as the items in it. A house insurance plan essentially covers man-made and also natural situations that may cause damages or loss.

Our Renters Insurance Statements

When your automobile is accountable for an accident, third-party insurance policy takes treatment of the damage triggered to a third-party. It is likewise crucial to note that third-party motor insurance is necessary as per the Electric Motor Cars Act, 1988.

A hospitalization expenditures up to the sum guaranteed. When it pertains to health and wellness insurance, one can choose a standalone health and wellness plan or a family advance strategy that offers coverage for all family participants. Life insurance offers insurance coverage for your life. If a situation happens in which the insurance holder has a sudden death within the term of the policy, then the candidate gets the compare car insurance amount guaranteed by the insurance business.

Life insurance is different from general insurance policy on numerous specifications: is a temporary agreement whereas life insurance policy is a lasting contract. When it comes to life insurance policy, the advantages as well as the amount guaranteed is paid on the maturation of the policy or homeowners insurance in case of the policy holder's death.

The basic insurance coverage cover that is required is third-party liability vehicle insurance. Each and every kind of general insurance cover comes with a purpose, to use protection for a specific element.

Report this wiki page